Lifetime in the united kingdom are twenty four hours-aspire to of numerous. However it might possibly be a real possibility for you! A great USDA financing, one of several government’s least-known financial guidelines programs, could get you there!

Brand new You.S. Company out-of Agriculture are permitting make home buying a possibility to possess low- to reasonable-earnings group into extra one an increase of the latest people can assist rural organizations restore and you may/or consistently flourish.

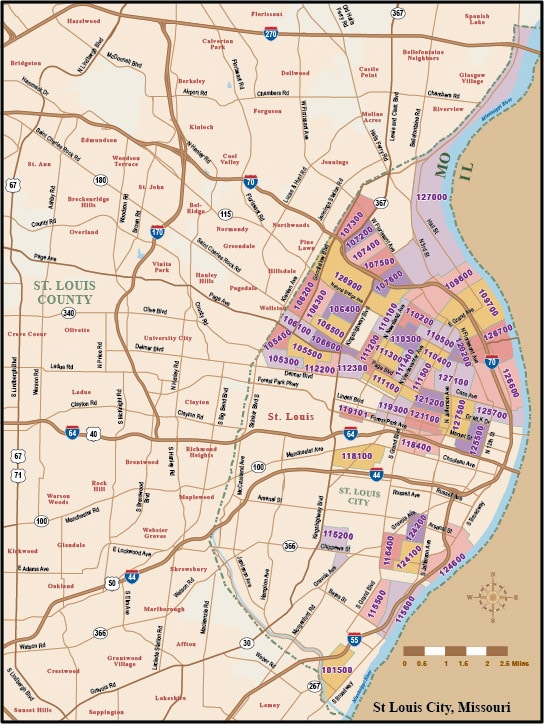

Given that 2017, the fresh USDA financing program features assisted people purchase and you will update their land through providing low interest rates with no down money. Complete, these types of financing is kepted getting homeowners trying to are now living in rural aspects of the world, but in particular states, residential district components can be integrated.

Have you been entitled to an excellent USDA loan?

Usually do not ignore the chance to find out about USDA thinking it is really not to you personally. Qualifications standards to own USDA-backed mortgage loans depend on merely a couple of things. New USDA home loan criteria is actually:

- Location: To acquire a great USDA home loan, the home you purchase have to be in the a beneficial USDA appointed rural area. One to sounds like it is all sphere and you can farmland, but never become conned: 97% of the nation is eligible, as well as brief towns and many suburbs.