Lifetime in the united kingdom are twenty four hours-aspire to of numerous. However it might possibly be a real possibility for you! A great USDA financing, one of several government’s least-known financial guidelines programs, could get you there!

Brand new You.S. Company out-of Agriculture are permitting make home buying a possibility to possess low- to reasonable-earnings group into extra one an increase of the latest people can assist rural organizations restore and you may/or consistently flourish.

Given that 2017, the fresh USDA financing program features assisted people purchase and you will update their land through providing low interest rates with no down money. Complete, these types of financing is kepted getting homeowners trying to are now living in rural aspects of the world, but in particular states, residential district components can be integrated.

Have you been entitled to an excellent USDA loan?

Usually do not ignore the chance to find out about USDA thinking it is really not to you personally. Qualifications standards to own USDA-backed mortgage loans depend on merely a couple of things. New USDA home loan criteria is actually:

- Location: To acquire a great USDA home loan, the home you purchase have to be in the a beneficial USDA appointed rural area. One to sounds like it is all sphere and you can farmland, but never become conned: 97% of the nation is eligible, as well as brief towns and many suburbs.

- Income: To begin with readily available for reasonable- to help you modest-money earners, the fresh USDA loan guidance identify money top as actually as much as 115% of median money to the part you are looking to live inside. Which might be a fortune in many components of the country, but it would depend in which you need it. At exactly the same time, a household’s whole earnings is recognized as in the application techniques, that helps increase eligibility.

Where to search to own eligible USDA Mortgage properties

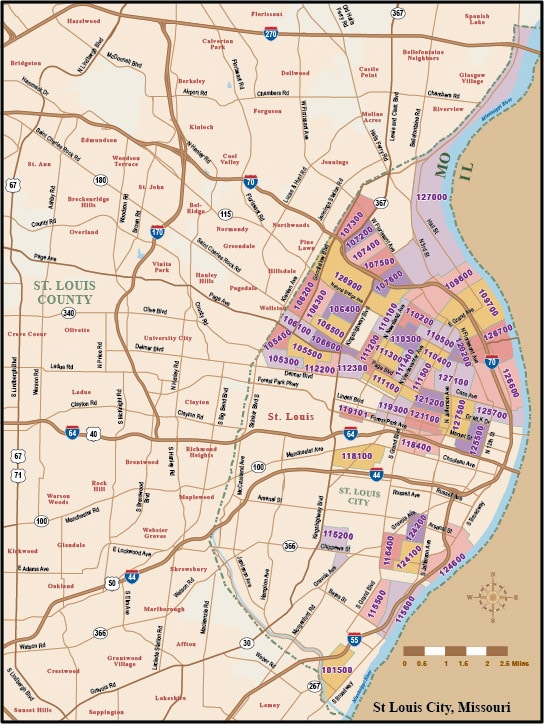

The newest USDA mortgage chart helps you figure out for which you can find an eligible assets. Once you understand and therefore home otherwise section qualify will shield you from making an offer for the a property that isn’t probably going to be appropriate finally.

In a nutshell, towns was omitted of USDA software, however residential district and you can ex lover-metropolitan urban centers enable you to get very near the buzz of some smaller metropolitan areas. The fresh map will help you ferret these parts away. But if you are searching for the country lifetime, you are in fortune. Outlying metropolises will always qualified. Here are a few our previous blog post so you can weigh the pros and downsides from residing the town vs. the world.

Luckily for us, the USDA map web site is fairly simple to use and just takes a few presses to locate what you’re looking. This advice below will help result in the techniques smoother:

- Immediately following on the internet site, simply click Unmarried Relatives Property Secured and you will deal with brand new disclaimer.

- Choose a specific target and https://cashadvancecompass.com/payday-loans-ms/ you may zoom during the otherwise over to narrow in the on the qualified areas.

- Heavily populated areas could be shaded yellow, showing they are ineligible. Zoom much more, and select qualified elements within the red-colored zones.

- After you’ve recognized an eligible area, appeal your house browse in that particular neighborhood.

Today show the eligibility

To ensure you’re qualified out of an income perspective, just remember that , Money constraints for a mortgage make sure are different of the area and measurements of your loved ones. Remember that so you’re able to qualify, family money cannot be over 115% of the average earnings to the area you have in mind. Utilize this graph to find out if your meet the requirements.

- You ought to are now living in the home complete-go out. USDA Finance can fund simply holder-occupied no. 1 houses.

- You truly must be an effective U.S. resident otherwise has actually long lasting residency.

- Their month-to-month financial obligation payments shouldn’t meet or exceed 41% of your own month-to-month income. However, this new USDA usually think large personal debt ratios if you have a credit history significantly more than 680.

Advantages of a great USDA Mortgage

If you think you will be eligible and looking and make your primary house in a USDA-qualified zone, then an outlying financial may be the right fit for you. That’s great given that USDA money have many benefits over other home loan alternatives:

In advance

Regarding USDA money, you need assist navigating the requirements. However, one to thing’s needless to say, you’ll want to rating pre-accepted in advance household search. Affect a movement Mortgage loan administrator in the region you might be looking to purchase.

Mitch Mitchell was a freelance contributor in order to Movement’s purchases service. He as well as writes regarding the technical, on the internet defense, the digital education society, travelling, and you will living with pets. However like to live somewhere warm.