Simply how much of your income is employed upwards purchasing monthly obligations repayments? Our very own financial obligation to earnings proportion calculator the fresh new percentage of their monthly debt money on the gross monthly money. This is exactly a well-known ratio utilized whenever being qualified for a financial loan however it is really vital that you that see just how affordable the debt is actually.

Very loan providers highly recommend your debt-to-earnings ratio shouldn’t go beyond 43%. We think a ratio from 31% or less is exactly what you need to be economically healthy and you can things above 43% are reason for concern. If you’re against a proportion from 50% or maybe more, you have to know talking-to a debt specialist regarding the loans relief solutions.

Financial obligation Ratio:

30% or reduced: A. You are probably Okay. Debt repayment is not taking a significant amount of your monthly spend, leaving you space to improve your payments sufficient to repay your financial situation on your own. Make your budget, perform a repayment package, follow you to bundle and almost certainly wind up when you look at the much better contour within this a year.

31-42%: In check. Even though you could probably would having a financial obligation installment proportion it higher, you are in the maximum directory of acceptable. If a great number of the bills enjoys variable rates focus (like personal lines of credit) start working to attenuate the debt today while the rising rates of interest means more of your own paycheque could be going on obligations installment later. When you find yourself simply and come up with lowest costs, the following month maintain your money the same. That have a top, fixed, payment, allows you to escape personal debt sooner or later.

43-49%: Cause of Matter. Any version from inside the income otherwise appeal normally set you in the possibility area. For folks who merely incorporated minimum repayments, you do not have sufficient space on the earnings to improve your repayments sufficient to pay off your non-financial bills. We help the majority of people with expenses in this variety generate a successful proposal to have limited cost to their financial institutions.

50% or more: Dangerous. In the event the financial obligation cost is taking on more fifty% of your paycheque, youre up against a financial obligation crisis which you probably can’t package with yourself. It is time to discuss options for financial obligation forgiveness, so you’re able to reduce your monthly payment in order to a much more affordable top.

So you’re able to calculate new share of income ate of the financial obligation installment, submit the fresh new number inside our easy-to-have fun with financial obligation-to-income ratio calculator.

Include all of the money source, together with a position money, your retirement, assistance money, and authorities direction. While you are thinking-working, include the gross providers income websites regarding working costs but before taxation and personal experts.

Lease otherwise mortgage repayment Charge card money Vehicles money Student loan costs Bank or other loan money Installment financing, rent-to-own Other loans payments Full Month-to-month Personal debt Repayments

We were both book and you may home loan repayments within calculation. As to the reasons? Given that a mortgage is a critical component of of a lot people’s financial obligation problems, and to make the ratio equivalent, people without a home loan would be to replace their month-to-month book percentage.

You may also have to add in monthly spousal service money in the event that this type of financial obligation use up a serious portion of your income.

Such as, in the event your complete monthly money are $2,800 along with your financial obligation money totaled $step 1,2 hundred in that case your personal debt-to-earnings ratio is:

Information your debt-to-income ratio

A low loans-to-earnings ratio (DTI) assurances you can afford the debt you hold. If you find yourself trying to get a unique mortgage, loan providers consider carefully your financial obligation-to-earnings proportion within the loan acceptance techniques at exactly the same time on credit history.

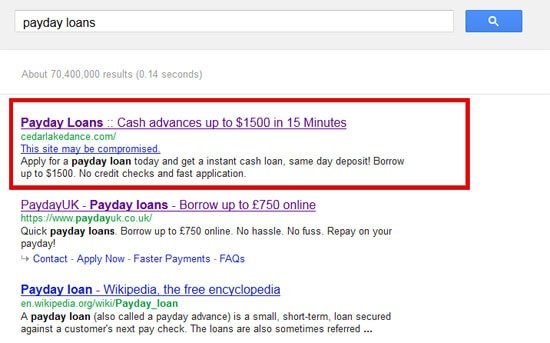

The type of personal debt you bring is also a cause of evaluating the brand new reasonableness of your DTI. A leading proportion motivated of the a beneficial personal debt such as a home loan was much better than a leading ratio on account of large unsecured debt such as for instance credit cards otherwise payday loans.

- 30% otherwise smaller is useful

- 31% in order to 42% are manageable

- 43% to help you forty two% is reason behind question

- 50% or maybe more was harmful

You will probably possess increased personal debt-to-earnings proportion on your own younger ages, specifically if you live in the a region with high actual house viewpoints particularly Toronto or Vancouver. As you method advancing years, you will want to lower your financial obligation load, it is therefore reasonable once you secure the down fixed advancing years earnings.

Cutting your obligations stability

You can change your debt-to-earnings proportion sometimes from the increasing your money or by reducing the financial obligation. For many individuals, the original option is not practical; but not, men should have an intend to get out of financial obligation.

- Make a resources and build a personal debt payment bundle

- Combine loans to lessen desire will cost you and you will pay back balances ultimately

- If you find find links yourself experiencing extreme debt, talk with a licensed personal debt elite group on the selection which will help your reduce loans in the course of time.

With the intention that you are making progress, recalculate your debt-to-income proportion most of the few months. From the viewing your own DTI fall, you are likely to are nevertheless motivated to carry it off after that.