You are able to Straight down Commission

The payment per month toward an unsecured loan is also less as compared to shared minimum repayments into playing cards. You need to use the money out of this difference between costs to stop trying out the fresh new financial obligation, help save into a primary buy, or manage a crisis fund.

Occasionally, your own monthly financing commission might possibly be more than the fresh new mutual lowest money on your credit cards. A high loan percentage may help you retire the debt smaller and you can result in your spending reduced attract total. It is important to find that loan fee number that works which have your financial budget and you will matches your aims. You never want the loan fee add up to create a money flow state which will cause a belated percentage.

A flat Rewards Day

When you make the minimum payment each month, you tend to don’t discover an obvious loss in your own credit card balances. Once the lowest payment of many handmade cards was a portion of newest equilibrium, as your equilibrium falls, therefore do the minimum fee number. And additionally, their minimal fee often is as much as 1 percent of one’s equilibrium and appeal. After you shell out thus absolutely nothing every month, it’s difficult to repay your debt rapidly. Simultaneously, an unsecured loan keeps an appartment mortgage label and you will a set payment number. You understand in the event your debt would be retired, and it’s really an objective you can works towards per month.

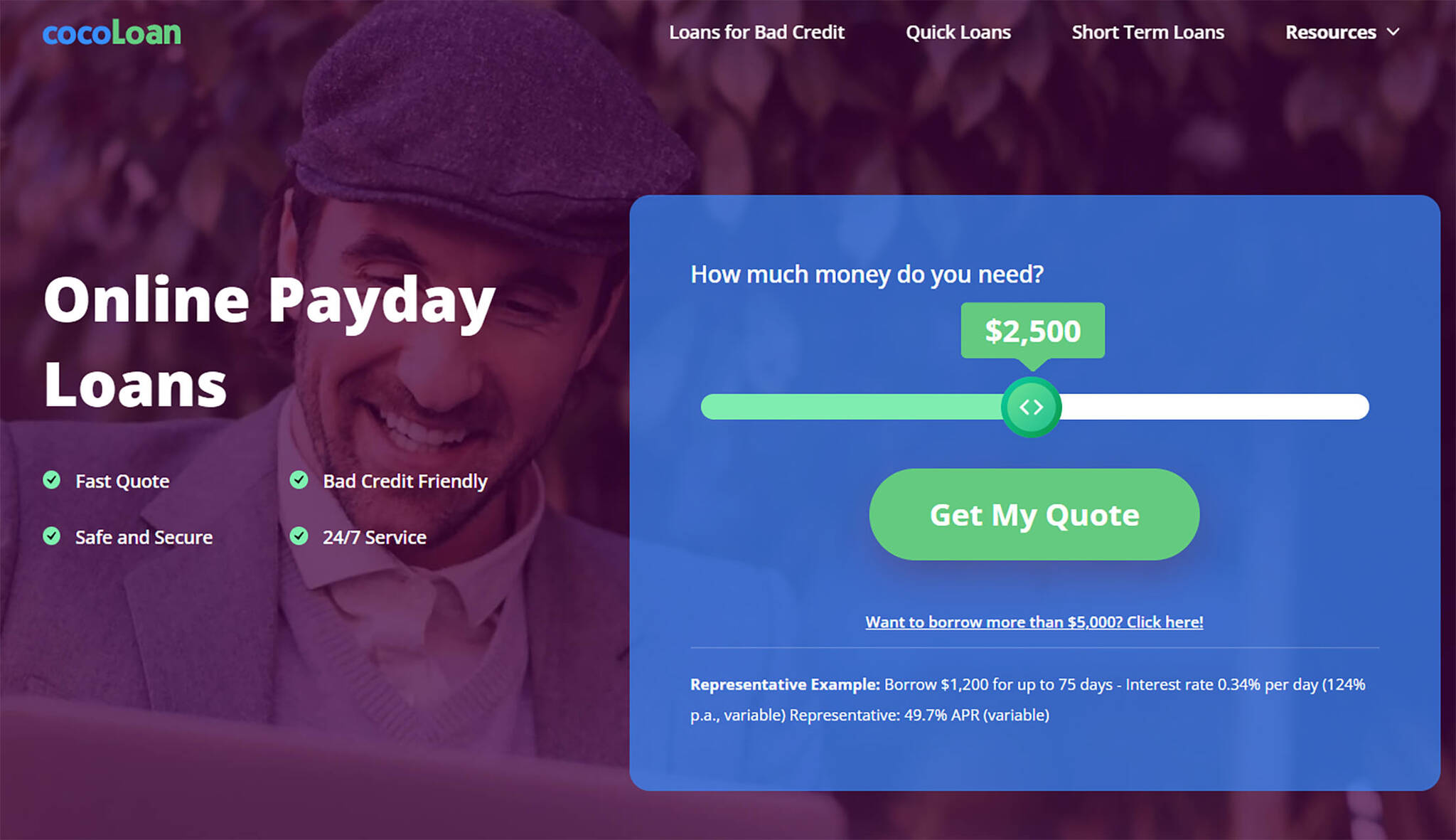

Getting a personal loan

The method to find a personal bank loan tends to be simple. Very lenders ask you to done an easy on the internet app. Using the first pointers your render, the financial institution tend to pre-meet the requirements you for a financial loan and you can send you a deal. If you opt to accept the newest lender’s render, the lending company will make certain every piece of information your give just before providing a final financing acceptance.

Pre-Qualifying For a loan

Quite often, completing an internet software to pre-be eligible for financing will probably be your first faltering step. Plus your title and make contact with guidance, you are requested to add your go out from delivery, Public Coverage count, money, monthly obligations, and you can company advice. Given that bank possess your own earliest advice, they will certainly manage a mellow credit check. This can perhaps not connect with your credit rating, however it does allow the lender to offer an effective mortgage render. When evaluating even offers, glance at the loan amount, payment per month number, term, and you can interest to discover the loan that actually works ideal for you. You will want to take a look at loan words very carefully. Prepayment charges and you will operating charges could add for the price of their loanparing this new annual percentage rate (APR) of any render is effective because facts on charge of this loan as well as the interest rate.

Last Recognition

After you settle on the deal you would like, you will need to provide some most documents to verify your own guidance before you can rating a last mortgage approval. This may were data files about your income, personality, and you can target. Like, a duplicate of the driver’s license or state ID are always be sure the identity. A good W-2 mode and you will paystubs can be used to file your income. In the event the financing is approved once a look at your documents, the lending company best student loan refinance fixed rate may work on a painful credit assessment having you to otherwise more of the credit agencies. The past step-in the process is the fresh new investment of the mortgage. How quickly you can get your finances depends on the lending company. Some are capable pass they for your requirements in one so you’re able to two days of one’s anticipate of the latest financing give.